RULE 17

The False Claims Act Reborn—With a Vengeance

Introduction

The False Claims Act (FCA), also known as “The Lincoln Law,” addresses fraudulent use of government and taxpayer funds. It applies to situations such as hospitals overcharging for equipment or companies submitting false government loan applications.

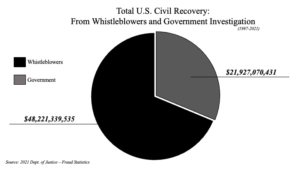

The FCA’s qui tam provisions empower private citizens to file lawsuits on the government’s behalf if they discover fraudulent activity. With no limit on rewards, the FCA has granted over $8.619 billion to whistleblowers since its 1987 amendment, contributing to nearly 70% of all civil fraud recoveries by the Justice Department.

Practice Tips

- State and local FCAs signed into law as of 2022 are listed in Checklist 1.

- The False Claims Act is codified at 31 U.S.C. § 3729–32. Its legislative history is contained in Senate Report No. 99-345 (July 28, 1986) and Senate Report No. 110-507 (Sept. 17, 2008).

- Recent Supreme Court cases interpreting the FCA are KBR v. U.S. ex rel. Carter, 135 S.Ct. 1970 (2015) (clarifying first to file rule and statute of limitations); U.S. ex rel. Escobar v. Universal Health Services, 136 S.Ct. 1989 (2016) (recognizing implied certification claims); and State Farm v. U.S. ex rel. Rigsby, 137 S.Ct 436 (2016) (sanctions for violating seal).

Resources

The False Claims Act (FCA), 31 U.S.C. § 3729–32.

Modern Legislative History of the FCA:

- Legislative materials for the 1986 FCA amendment p S11244 (Grassley)

- Committee on the Judiciary, “The False Claims Act of 1985,” S. Rep. 99-345, 99th Cong., 2nd Sess. (1986). The major interpretive tool for understanding the 1986 amendments to the FCA that revitalized the law

- Committee on the Judiciary, “The False Claims Act Correction Act of 2008,” S. Rep. 110-507, 110th Cong., 2nd Sess. (2008)

Although the 2008 Senate Report concerns the False Claims Act Corrections Act, a law that was never passed by Congress, in 2009–10 many of its provisions were approved (either in whole, in part, or in a modified form) and signed into law:

- Fraud Enforcement and Recovery Act, Public Law No. 111-21, § 4 (May 20, 2009)

- Patient Protection and Affordable Care Act, Public Law No. 111-148, § 10104(j)(2) (Mar. 23, 2010)

- Dodd-Frank Act, Public Law No. 111-203, § 1079A (July 21, 2010).

The 2008 Senate Report is an excellent starting point for understanding these three amendments.

- Committee on the Judiciary, “Fraud Enforcement and Recovery Act of 2009,” S. Rep. 111-10, 111th Cong. 1st Sess. (2009) (legislative history for the 2009 FCA amendments)

- Extension Remarks by Congressman Berman, Congressional Record, pp, E1296–97 (June 3, 2009)

2023 Supreme Court Decision on Dismissing False Claims Act Case Over the Objection of a Whistleblower or Relator:

Decisions interpreting the original intent of the FCA:

- U.S. ex rel. Marcus v. Hess, 317 U.S. 537 (1943)

- United States v. Griswold, 24 F. 361 (D. Ore. 1885)

Decisions interpreting the 1986 amendments:

- Vermont Agency of Natural Resources v. U.S. ex rel. Stevens, 529 U.S. 765 (2000) (FCA is constitutional)

- Rockwell International Corp. v. U.S. ex rel. Stone, 549 U.S. 457 (2007) (limiting recoveries by relators – partially reversed by 2010 amendment to FCA)

- Cook County v. U.S. ex rel. Chandler, 538 U.S. 119 (2003) (municipal corporations covered under FCA)

- KBR v. U.S. ex rel. Carter, 135 S.Ct. 1970 (2015) (clarifying statute of limitations and original source standards)

- Universal Health Services v. U.S. ex rel. Escobar, 136 S.Ct. 1989 (2016)

- State Farm v. U.S. ex rel. Rigsby, 137 S.Ct. 436 (2016) (sanctions for violating seal)

The broad coverage of employers and contractors under the FCA’s anti-retaliation provision was explained in U.S. ex rel. Bias v. Tangipahoa Parish School Board, 816 F.3d 315 (5th Cir. 2016).

Articles explaining the FCA and qui tam:

- “The History and Development of Qui Tam,” Wash. U. L. Q. 81 (1972).

- Claire Sylvia, “The False Claims Act: Fraud against the Government,” Thomson/West (Danvers, MA, 2004).

- Joel Hesch, “Understanding the ‘Original Source Exception’ to the False Claims Act’s ‘Public Disclosure Bar’ in Light of the Supreme Court’s Ruling in Rockwell v. United States,” 7 DePaul Bus. & Com. Law Journal 1 (Fall 2008).

Elleta Callahan and Terry Dworkin:

- “Do Good and Get Rich: Financial Incentives for Whistleblowing and the False Claims Act,” 37 Vill. L. Rev. 273 (1992).

- Thomas Harris, “Alternative Remedies & The False Claims Act: Protecting Qui Tam Relators in Light of Government Intervention and Criminal Prosecution Decisions,” 94 Cornell Law Review 1293 (2009)

The U.S. Department of Justice discloses information on FCA recoveries on the web page for the Civil Division, Commercial Litigation Branch. See DOJ Civil Fraud press releases regarding FCA settlements and judgments. The Civil Frauds web page also has statistics on FCA recoveries and a “primer” outlining basic tenants of the FCA.

“The bill offers…a reward to the informer who comes into court and betrays his co-conspirator, if he be such; but it is not confined to that class…I have based the [False Claims Act] upon the old-fashioned idea of holding out a temptation, and ‘setting a rouge to catch a rogue,’ which is the safest and most expeditious way I have ever discovered of bringing rogues to justice.”

Quick Links

Frequently Asked Questions

Related Rules

Order Your Copy Today!

All purchases or donations proceeds go to support the National Whistleblower Center, a 501(c)(3) non-profit organization dedicated to supporting whistleblowers.

Shipping is to the United States Only

For international orders, please contact [email protected].