IRS Whistleblower Program: A Comprehensive Overview

The IRS Whistleblower Office pays awards to whistleblowers who report specific and credible information whose information results in the collection of taxes, penalties, interest or other amounts from the non-compliant taxpayer. Learn more about the IRS Whistleblower Program in this detailed FAQ.

Updated

May 14, 2025

Introduction

The IRS Whistleblower Office was created in 2006 to administer the IRS Whistleblower Program, which awards eligible individuals who report specific and credible information to the IRS, which results in the collection of taxes, penalties, interest or other amounts from the non-compliant taxpayer.

The type of non-compliance can range from illegal offshore tax evasion and illegal shell bank accounts, to false reporting, pyramiding, and the simple underpayment of taxes.

The IRS Whistleblower Program is one of the strongest anti-fraud award programs available to tax whistleblowers who report tax evasion and fraud. Since it’s inception in 2007, the IRS has paid over $1.2 billion in awards, and collected over $7 billion from tax non-compliance.

Some of the key features of the program include the following:

- Awards: Whistleblowers may be eligible for an award between 15 and 30% of the proceeds collected and linked to their information.

- Related Actions: Permitting the payment of rewards based on sanctions obtained from other law enforcement agencies.

- Protection: the IRS prohibits retaliation against whistleblowers for reporting tax fraud, underpayment, or other illegal activities.

- Confidentiality: Although anonymous filing is not permitted, the IRS takes strong measures to protect confidentiality.

- International: Non-U.S. individuals may blow the whistle on major tax non-compliance or fraud by U.S. taxpayers or those who assist them.

Below is a brief overview of the IRS Whistleblower Program with important information about these key features, and steps to becoming a whistleblower if you have information about tax non-compliance or fraud.

History of the IRS Whistleblower Office

The IRS Whistleblower Office was established by the Tax Relief and Health Care Act of 2006. This office is tasked with processing tips from individuals, such as whistleblowers, who have knowledge of significant tax noncompliance to provide that information to the IRS.

A principal reason for enacting the law is that Congress recognized that detecting tax evasion and tax fraud is very difficult for the government to detect due to their complexity and the lack of resources to audit or investigate all returns.

The office pays monetary awards to individuals whose information is used by the IRS. The percentage of the award falls between 15 and 30% of the proceeds collected and linked to the whistleblower’s information. The percentage a whistleblower receives mary vary, depending on various award factors.

As a result of enacting a robust tax whistleblower law, the IRS receives reports of serious tax fraud from whistleblowers, many of whom have inside knowledge of the complex financial transactions and other illegal conduct that results in tax fraud.

Whistleblowers often provide extensive documentation to support their claims that would not have been otherwise known to the IRS.

IRS Whistleblower Awards

Individuals who provide information leading to the collection of taxes may receive an award of 15 and 30% of the collected proceeds. To become eligible, the tax non-compliance must first meet the following criteria:

- Taxpayer Income: The taxpayer’s gross income must exceed $200,000.

- Amount in Dispute: The amount of taxes in dispute must exceed $2 million.

In referring to awards, the IRS may use the term proceeds, which refers to penalties, interest, taxes, and any other amounts collected due to the IRS’s enforcement of tax laws, including criminal fines, civil forfeitures, and violations of reporting requirements.

There is no contract required to receive a whistleblower reward from the IRS. It’s advised that whistleblowers obtain legal representation, as the whistleblowing and award process is complex. Failure to meet any the requirements may result in your case being denied or dismissed.

Reduced Awards

If the information provided is based on publicly available sources, which is considered “less substantial,” the award may be reduced to an award of no more than 10% of the proceeds collected as a result of the action, related actions, or settlements.

No Award

It is also possible for a whistleblower to be ineligible for an award if they were involved in planning or initiating tax evasion. In fact, these whistleblowers may actually face criminal charges.

Related Actions

Additional compensation may also be available if a whistleblowers initial information leads to continued investigations or legal actions that lead to tax collection. This is most common if the information triggers a broader investigation that uncovers subsequent tax evasion or fraud.

Remedies

Employees who win a retaliation case my be entitled to full compenation, including damages, such as back pay, full benefits, and interest. They can also recover costs like attorney fees or witness fees. In summary: if they are relatiated against, they are entitled to a full range of remediesto make them whole, and they cannot wave the right under this law.

IRS Whistleblower Awards Paid Since Inception

Since issuing the first award in 2007 through June 2024, the IRS Whistleblower Office has collected over $7 billion from non-compliant taxpayers, and have paid awards totaling over $1.2 billion. Whistleblowers play a vital role in bolstering the fair and effective enforcement of nation’s tax laws.

IRS Whistleblower Award Amount Paid Each Year

IRS Awards Paid Each Year

IRS Whistleblower Office Annual Reports

To get a complete breakdown of the awards paid by year, we suggest reading the following annual report, which are put out each year by the IRS Whistleblower Office:

- Whistleblower Office YTD Report (January 1 – July 30, 2024)

- Whistleblower Office FY2023 Annual Report

- Whistleblower Office FY2022 Annual Report

- Whistleblower Office FY2021 Annual Report

- Whistleblower Office FY2020 Annual Report

IRS Whistleblower Protections

Employers are prohibited from retaliating against employees for reporting any sort of tax non-compliance, fraud, or other violations, or assisting the IRS in an investigation. This means they may not discharge, demote, suspend, threaten, harass, or in any other manner discriminate against an employee in the terms and conditions of employment for doing what’s legally right.

Employees who experience relaliation can file a complaint with the Secretary of Labor or sue in federal court, but only if the Secretary of Labor fails to act within 180 days. There are specific procedures and rules outlined in other federal laws with these cases. It’s important for employees to know that they have 180 days to file a complaint from the date in which the retaliation started. In cases that go to court, employees have the right to a jury trial.

Anonymous Tips

The IRS does not allow for anonymous whistleblowing. However, they do vow to maintain strict confidentiality throughout the process.

Still, there are ways submit a tip without revealing your identity. This includes hiring a whistleblower lawyer who can file a whistleblower tip on your behalf, and act as an intermediary between you, the IRS and courts.

whistleblower attorney has a solid understanding of the law and will protect your identity to the fullest extend possible under law. And if you experience retaliation, a whistleblower attorney can help you file a complaint immediately.

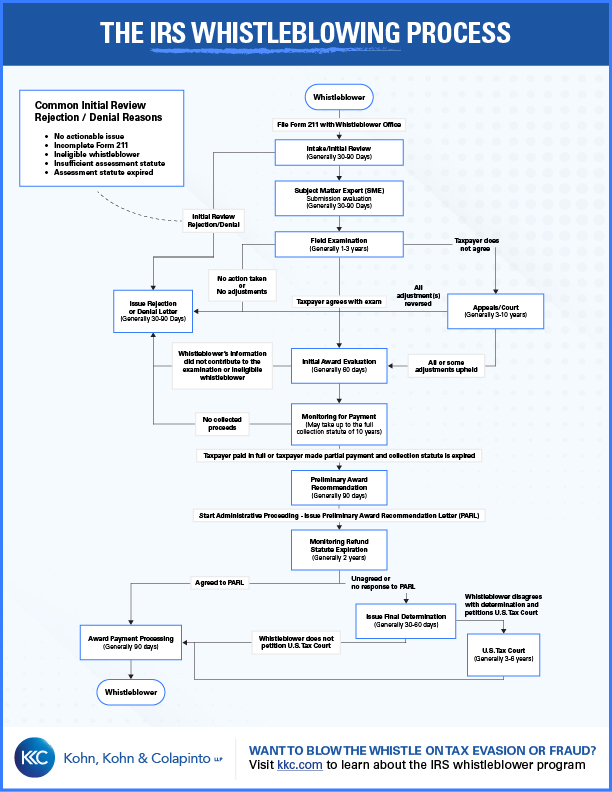

The IRS Whistleblower Program Process

Submitting a whistleblower claim is a relatively straightforward process, that can be done with or without the help of an IRS whistleblower attorney. However, we strongly recommend hiring an experienced attorney, as there are many rules and requirements in order for the IRS to pursue a case, and additional rules to apply for an award. Below is a generalized overview of the steps an individual might take in filing a whistleblower claim under the IRS whistleblower program:

1. Determine Eligiblity

Under section 7623 of the Internal Revenue Code, any individual, U.S. or foreign, who has information of tax non-compliance may file for an award, EXCEPT, if they meet the following criteria:

- Current or former U.S. Treasury employee who obtained information while employed.

- Federal employee who obtained information from their role.

- Individual required or prohibited by law from disclosing the information.

- Individual with a contract to access the information.

- Individual filing a claim based on information from an ineligible whistleblower

And in order to qualify for an award, as stated above, the following conditions must be met:

- Taxpayer Income: The taxpayer’s gross income must exceed $200,000.

- Amount in Dispute: The amount of taxes in dispute must exceed $2 million.

2. Hire An Attorney (Recommended)

Many whistleblowers underestimate the complexity of submitting a tip and filing for an award if they become eligible. There are many rules, that if not followed correcly, could result in your tip being rejected or your deserved award amount being reduced to a lower pecentage. Attorney can offer you expert guidance, leading you through the process to ensure your claim is filed correctly. In addition to their expertise in the claims process, they can also help protect you from retaliation, mitigate risks, negotiate on your behalf, and provide strong advocacy throughout the process.

3. Submit a Claim

Whistleblowers, by themselves or with the assistance of an attorney, must file Form 211, Application for Award for Original Information. This form will require you to provide the following information:

- Description of Tax Non-Compliance: This is a written explanation of the tax issue(s) in detail.

- Supporting Evidence: This might include copies of documents such as records, books, receipts, emails, or other transactions.

- Missing Documents: This includes any documents that might not be in your possession that would support the claim.

- Awareness of the Issue: An explanation about how you learned about the issue(s).

- Relationship to Individual: An overview of how you are connected with the person being reporting.

- Signed Declaration: Whistleblowers are required to sign their statement under oath.

4. Claim Processing

Once your claim has been submitted, the IRS will process it to determine whether they’ll reject it, or file it under 7623 (a) or (b) as per the Internal Revenue Code (IRC). If a claimant’s submission does not meet the criteria for IRC section 7623 (b) consideration, the IRS will consider it for the discretionary program under IRC section 7623 (a) of the Code.

5. Award Determination

The Whistleblower Office will communicate the final claim determination, in writing to the claimant. Determinations regarding awards under 7623 (b) may, within 30 days of such determination, be appealed to the US Tax Court. However, decisions under section 7623 (a) may not be appealed to the Tax Court.

While the IRS pays whistleblower awards from collected proceeds which result from an audit or investigation, there can be substantial delays and technical requirements that must be met. Because payments are not made until the taxpayer has exhausted all appeal rights and the statutory period for the filing of a claim for refund has expired or been waived by the taxpayer, the IRS may not make payments for several years after the whistleblower has filed the claim.

There are several positive and negative award factors that determine the percentage you’ll receive. For instance, reporting the tax issue promptly is a positive factor and may increase your award percentage. However, dragging out the filing process until the last minute will lower the percentage. Again, to reiterate from the award section above, the percentage ranges from 15 to 30% of the collected proceeds.

Seek Legal Assistance

Kohn, Kohn and Colapinto has been in the trenches of IRS whistleblower protection for over 35 years. Our firm is behind roughly a third of all IRS whistleblower cases, including the landmark Bradley Birkenfeld case that exposed Swiss banking and landed Birkenfeld an award of $104 million, the largest at the time.

Not to mention, we have filed rulemaking petitions, testified at rulemaking hearings, filed amicus curiae briefs in precedent-setting tax whistleblower cases, and helped push for legislation to improve the efficacy of the IRS Whistleblower Program.

Your initial consultation is free and confidential, and in many cases our attorneys work on a contingency basis. Meaning, we only get paid if we get an award for you. Contact our firm today if you’re seeking a top IRS whistleblower attorney to work on your case.

Our Firm’s Cases

$112.6 Million Award

Confidential Whistleblower’s disclosures resulted in 461 tax cheats paying over $562.9 million in fines and penalties. Whistleblower obtained awards of over $112.6 million. Client’s disclosures expected to trigger millions in additional awards and sanctions in 2024.

$11.9 Million Award

In July 2023, our client was awarded a significant sum of $11.9 million due to their involvement in the Tax Whistleblower Award Case No. 2015-11701. The IRS’s program for whistleblowers is a crucial mechanism that incentivizes individuals to spotlight tax fraud.

$11.9 Million Award

July 2023, our client obtained an award of $11.9 million in Tax Whistleblower Award in Case No. 2015-11793. The IRS whistleblower program offers substantial financial rewards to individuals who expose tax fraud.

Relevant FAQs

Latest News & Insights

FAQs

Ready to blow the whistle? Our experienced team is here to protect your rights and guide you through the process. Contact us today for a confidential consultation.