May 14, 2025

![The Irs Whistleblower Claims Process [updated Guide 2024] The IRS Whistleblower Claims Process](https://kkc.com/wp-content/uploads/2023/06/IRS-Whistleblower-Process.jpg)

This information is provided for educational purposes only by Kohn, Kohn & Colapinto and does not constitute legal advice. No attorney-client relationship is created by accessing this content. Laws and regulations may change, and this material may not reflect the most current legal developments. If you believe you have a whistleblower claim, consult a qualified attorney to discuss your specific circumstances.

What Qualifies for An Award?

The IRS offers awards to whistleblowers who submit information that helps them uncover tax cheating and violations of tax laws. To be eligible for an award, your information must meet certain criteria:

- Specific and Credible Evidence: You must provide details and evidence that the IRS considers reliable to believe there’s a tax problem.

- Leads to Collected Taxes: The information you provide must ultimately lead to the IRS collecting additional tax revenue. This could include penalties, interest, and unpaid taxes.

- Not Publicly Known: The information you provide cannot be already known from public sources.

The IRS awards whistleblowers a percentage of the recovered taxes, typically between 15% and 30%. The exact percentage depends on specific factors, including:

- Originality of Information: If the information comes from public sources, the award percentage is lower.

- Whistleblower’s Role: If the whistleblower actively participated in the tax scheme they’re reporting, the award percentage is lower.

There are two main IRS whistleblower award programs:

- IRC Section 7623(b): This program applies to cases involving high-dollar tax fraud (over $2 million in recovered taxes) and individuals with significant income (over $200,000).

- IRC Section 7623(a): This is a discretionary program for cases that don’t meet the criteria for (b).

For the official regulations and complete details on the whistleblower program, you can visit the IRS website.

Submitting a Whistleblower Claim: IRS Form 211

To file a whistleblower claim with the IRS, you’ll need to complete and submit IRS Form 211, Application for Award for Original Information. This form gathers details about your allegations and supporting evidence. Here’s what you’ll need to include:

- Details of the Alleged Tax Issue: Provide a written explanation of the suspected tax noncompliance.

- Supporting Documentation: Attach any documents that support your claims. This could include financial records, emails, contracts, or anything that helps prove the wrongdoing.

- Unavailable Evidence: If there’s evidence you can’t access, explain what it is and where it might be located.

- How You Learned About the Issue: Explain how and when you became aware of the tax problem.

- Your Relationship to the Subject: Describe your connection (if any) to the person or entity you’re reporting.

- Signed Declaration: You must personally sign the form under penalty of perjury.

Mailing Your Form

The IRS currently doesn’t accept faxed or electronic submissions.

Mail your completed Form 211 to the following address:

Internal Revenue Service Whistleblower Office – ICE

M/S 4110

1973 N. Rulon White Blvd.

Ogden, UT 84404

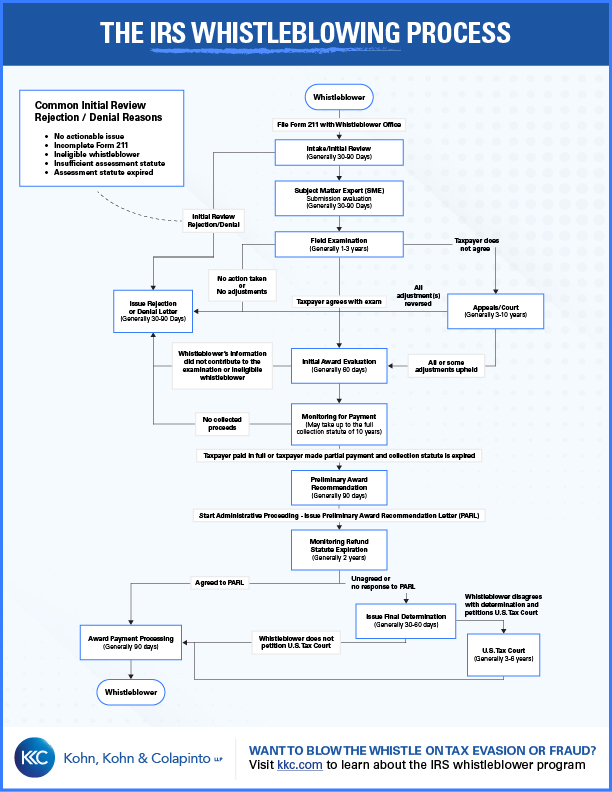

What Happens After You Submit Your Claim?

The IRS Whistleblower Office reviews each claim carefully. Here’s what you can expect:

- Review and Development: If your claim seems promising, the IRS will forward it to the appropriate specialists for further investigation.

- Contacting You: An expert may contact you for clarification or additional information on your allegations.

- Claim Outcome: The IRS will notify you by mail if they decide to pursue your claim or not.

- If not pursued: You’ll receive a letter explaining the reason for rejection.

- If pursued: The IRS will investigate the matter further.

Important Notes:

- Appeals Process: Taxpayers have the right to appeal IRS findings, which can take time to resolve.

- Award Payments: The IRS can only award you from recovered taxes. If the taxes aren’t collectible, you may have to wait for a specific period before receiving your award.

- Final Determination: Award payments are issued only after the IRS finalizes its actions, determines your award amount, and any appeals are settled.

Limited Communication Due to Confidentiality

Due to taxpayer privacy laws, the IRS Whistleblower Office can share limited information by phone. They can only confirm if your claim is open or closed.

For more detailed updates, you’ll need to submit a written request for a status update. The IRS will also send you a decision letter via mail for claim rejections, awards, or when your claim moves forward for examination.

Here’s a summary of what the Whistleblower Office might communicate:

- Claim Status: Open or Closed (by phone)

- Claim Outcome: Rejection, Award Amount, or Audit Referral (via decision letter)

- Tax Payment by Subject: This doesn’t guarantee an award (via notification letter)

Important Note: Receiving any notification (including referral for examination or tax payment by the subject) doesn’t guarantee you’ll receive an award. The process can take several years to finalize.

Checking the Status of Your Claim

While the IRS Whistleblower Office can’t share specific details about their investigation due to confidentiality, you can request a written update on the general status of your claim.

How to Request a Status Update:

- Submit a written request by mail. The IRS doesn’t accept faxes or electronic requests.

- Include the following in your written request:

- Your claim number

- Confirmation that you are the whistleblower or an authorized representative (with IRS Form 2848 on file)

- A statement requesting an update on the status or stage of your claim

Mail your request to:

Internal Revenue Service Whistleblower Office – ICE

M/S 4110

1973 N. Rulon White Blvd.

Ogden, UT 84404

What to Expect in the Response:

The IRS will respond by mail to the address you provided on your claim form (or an updated address). Their response will indicate:

- Whether your claim is open or closed

- A general status update on any investigation or action related to your claim (if applicable)

Important Notes:

- You can only submit one update request per claim number per year.

- The response you receive is separate from the final award determination, which will be addressed in a later section.

Understanding Your Award Determination

Due to confidentiality restrictions, the IRS Whistleblower Office is limited in what details they can share about your award decision.

Award Communication for Section 7623(a) Claims:

- Awards or claim rejections will be communicated by mail.

- Rejection letters will explain the reason for denial.

- The IRS is not obligated to respond to further inquiries on rejected claims under Section 7623(a).

Award Communication for Section 7623(b) Claims:

- Rejection letters will explain the reason for denial.

- If an award is recommended, you’ll receive reports explaining the factors considered and how your information impacted the investigation.

Requesting More Information on Section 7623(b) Determinations (if applicable):

If you have questions about your award determination for a Section 7623(b) claim, you can submit a written request by mail. However, the IRS may have already provided this information in the preliminary reports or determination letter.

How to Request More Information:

- Submit a written request by mail (no faxes or electronic requests).

- Include your claim number and confirmation that you are the whistleblower or an authorized representative.

Mail your request to the same address as claim status updates:

Internal Revenue Service Whistleblower Office – ICE

M/S 4110

1973 N. Rulon White Blvd.

Ogden, UT 84404

Updating Contact Information

It is important for the Whistleblower Office to have current contact information for whistleblowers in case the IRS needs to reach them, including phone number and mailing address. Failure to update your contact information with the Whistleblower Office may delay award processing.

Updating contact information with the IRS for personal individual income taxes will not update information with the Whistleblower Office.

Whistleblowers should send changes to their contact information to the Whistleblower Office as soon as possible to:

Internal Revenue Service

Whistleblower Office – ICE

M/S 4110

1973 N. Rulon White Blvd.

Ogden, UT 84404

Additional information

Find additional information about the rules for whistleblower awards in IRC Sections 7623(a) and 7623(b), on the disclosure rules to whistleblowers in IRC Section 6103(k)(13) and on the Whistleblower Program page at http://www.irs.gov.

Our Firm’s Cases

$112.6 Million Award

Confidential Whistleblower’s disclosures resulted in 461 tax cheats paying over $562.9 million in fines and penalties. Whistleblower obtained awards of over $112.6 million. Client’s disclosures expected to trigger millions in additional awards and sanctions in 2024.

$11.9 Million Award

In July 2023, our client was awarded a significant sum of $11.9 million due to their involvement in the Tax Whistleblower Award Case No. 2015-11701. The IRS’s program for whistleblowers is a crucial mechanism that incentivizes individuals to spotlight tax fraud.

$11.9 Million Award

July 2023, our client obtained an award of $11.9 million in Tax Whistleblower Award in Case No. 2015-11793. The IRS whistleblower program offers substantial financial rewards to individuals who expose tax fraud.

Relevant FAQs

Latest News & Insights

January 27, 2026