Federal healthcare fraud lawyers with nearly four decades of winning experience

Kohn, Kohn and Colapinto is one of the nation’s most experienced healthcare fraud law firms, using one of the nation’s strongest whistleblower laws – the False Claims Act.

Our team represents whistleblowers who report healthcare systems, medical providers, marketers or manufacturers committing fraud or abusing federal government programs to receive unauthorized benefits or payments from healthcare programs and insurers.

Types of fraud include kickbacks, upcoding, unbundling, phantom or duplicate billing, unnecessary medical procedures, Medicare Advantage and risk-adjustment fraud. We also work on cases involving violations of the Physician Self-Referral Law, known as the Stark Law.

If you know of a fraudulent scheme and would like to report your concerns, our team can help you determine if you’re eligible for protection and awards under the False Claims Act and other state and local False Claims Acts.

In most cases, we don’t get paid unless we win your case. Get in touch today for a free and confidential consultation with one of our leading healthcare fraud attorneys.

A History of Winning

Kohn, Kohn and Colapinto attorneys have helped numerous high-profile clients fight and win False Claims Act cases involving healthcare fraud.

This includes the notable case involving Daniel Richardson, who blew the whistle on his employer Bristol-Meyers Squibb (BMS) for off-label drug marketing and illegal kickbacks which increased costs to Medicare, Medicaid, Tricare and other government health care programs. While many whistleblowers participated in the settlement helping the government to recover over $500 million for taxpayers, Richardson received the largest qui tam relator share (award) of the whistleblowers who worked for the company.

Another case of ours was brought against Novartis, which paid millions in bribes to illegally market drugs. They were required to pay over $300 million in sanctions and fines for their illegal activity. The whistleblower in this case is anonymous and the award amounts are confidential.

Top Industry Achievements

Our firm is led by the world’s top attorneys and False Claims Act experts, including David K. Colapinto, the lead attorney behind the BMS case above, and Stephen M. Kohn, renowned whistleblower attorney named as America’s Top 200 Lawyers of 2024.

All partners of the firm are Martindale-Hubbell’s AV Preeminent, which is the highest level of peer review rating awarded to lawyers. There are very few achievements that top this distinguishment apart from our winning track record and legal success.

If you have information regarding healthcare fraud, there is no case too large for our firm to handle. We’ve got the experience and top industry awards to back up that claim.

What is Healthcare Fraud?

Healthcare fraud is a white-collar crime that involves intentional deception or misrepresentation of information to receive unauthorized benefits or payments from healthcare programs, insurers, or patients. Healthcare fraud violations can carry civil and criminal penalties and whistleblowers can file healthcare fraud cases using the False Claims Act qui tam law.

Healthcare fraud can be committed by various individuals or entities within the healthcare system, including medical providers, patients, and other individuals or organizations.

Common types of healthcare fraud include the following:

- Risk Adjustment Fraud: This involves the intentional manipulation or misrepresentation of patient data to secure higher reimbursements from healthcare programs – such as Medicare Advantage and Medicaid – that adjust payments based on the health and risk status of patients.

- Upcoding: This is an example of risk adjustment fraud but can also occur when a provider bills for a more expensive service than the one provided. For example, billing for complex surgery when only a minor procedure was performed.

- Unbundling: This is the practice of billing separately for procedures that are typically covered under a single, more comprehensive billing code, leading to higher overall charges. An example is a lab billing separately for each test in a panel instead of billing for the entire panel.

- Phantom Billing: This involves submitting claims for treatments, consultations, or procedures that were never actually performed.

- Billing for medical unnecessary services: This involves performing and billing for services that are not required for the patient’s health, often driven by financial incentives rather than medical necessity. An example is a doctor ordering excessive diagnostic tests that are not indicated by the patient’s condition.

- Kickbacks and referral fraud: This involves receiving or offering payments or incentives in exchange for referring patients to specific services or facilities. This can lead to biased medical advice and unnecessary treatments. For example, a physician accepts money from a medical imaging facility for referring patients.

- Duplicate billing: Submitting multiple claims for the same service or procedure. This can be due to errors or intentional fraud.

- Phantom supplies and equipment: Billing for medical supplies or equipment that were never provided or is unnecessary. This could include billing for items not ordered by the patient or significantly overpricing equipment.

- Prescription drug fraud: This involves the misuse of prescription medications for financial gain, such as forging prescriptions, over-prescribing medication, or diverting drugs for illegal sale.

- Medical identity theft: Using someone else’s medical identity to obtain healthcare services, goods, or funds fraudulently. This can involve using another person’s insurance information or creating fake identities.

- Falsifying diagnoses or medical records: Misrepresenting a patient’s condition to justify unnecessary procedures or higher reimbursement rates.

These are just a few of the most common types of fraud in healthcare that exist. But just how common are they?

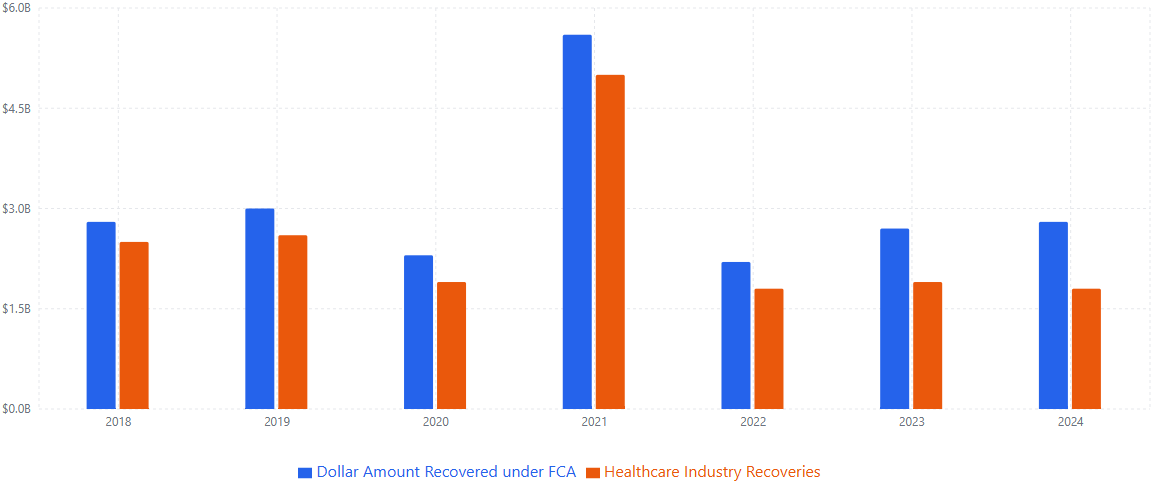

To put it into perspective, in FY 2024 alone, the Department of Justice (DOJ) recovered $2.9 billion in False Claims Act settlements and judgments, with healthcare fraud accounting for 57% of the total, according to the Department of Justice (DOJ), which represent a significant portion of the overall False Claims Act recoveries.

If you have information about a fraud, we strongly encourage you to contact our healthcare fraud attorneys today for a free consultation. Your information could help save lives and hold fraudsters accountable for their lies and deceit.

Healthcare Fraud and The False Claims Act

The False Claims Act (FCA) is a powerful legal tool used extensively to combat fraud within the healthcare industry in the United States. Given the significant amount of federal funding allocated to healthcare programs like Medicare and Medicaid, the FCA serves as a crucial mechanism to protect these resources from fraudulent activities.

General Requirements

To establish a violation of the FCA in a healthcare fraud scenario, the government or a whistleblower typically needs to demonstrate that there was a false or fraudulent claim for healthcare services or goods. The healthcare provider, entity, or individual submitting the claim must have acted knowingly (as defined above) regarding the falsity of the claim.

Whistleblower Awards

Whistleblowers who successfully bring qui tam lawsuits against those committing healthcare fraud are entitled to a share of the government’s recovery, which is between 15% and 25% of the total amount recovered.

If the government declines to intervene and the whistleblower successfully pursues the case on their own, their award can range from 25% to 30% of the recovery. Many FCA healthcare fraud cases are resolved through settlements. If the case goes to trial, a judgment will be made.

Confidentiality

When a qui tam lawsuit alleging healthcare fraud is filed, it is done under seal. This confidentiality period allows the government to investigate the allegations without the knowledge of the defendant, protecting the whistleblower from potential retaliation.

Whistleblower Retaliation

Individuals working within the healthcare industry often have access to fraudulent activities. The FCA provides critical protection for these whistleblowers who come forward to report such fraud. Healthcare fraud whistleblowers are also entitled to remedies such as re-instatement, double back pay with interest, and compensation for any special damages.

How To Report Healthcare Fraud

The qui tam provision of the FCA is particularly significant in uncovering healthcare fraud. It enables individuals with inside knowledge of fraudulent activities to file a lawsuit on behalf of the government. If you’re serious about filing a qui tam lawsuit, you must hire a U.S.-based attorney to represent you.

Below is the general qui tam lawsuit process:

- Filing Under Seal in Healthcare: A healthcare whistleblower (qui tam relator) files a complaint in federal court detailing the alleged healthcare fraud. This complaint is initially kept secret (also known as: under seal).

- Disclosure to the Government in Healthcare: The relator must provide the Department of Justice with a copy of the complaint and all supporting evidence.

- Government Investigation of Healthcare Fraud: The government investigates the allegations of healthcare fraud, often interviewing the whistleblower and reviewing the provided evidence. This investigation period can be extended.

- Government Decision to Intervene or Decline in Healthcare: The government decides whether to join the lawsuit (intervene) or allow the relator to proceed independently (decline). Intervention often signals a stronger case in the government’s view.

- Unsealing the Complaint in Healthcare: Once the government makes its decision, the lawsuit is typically unsealed and becomes public.

- Litigation of Healthcare Fraud: The case proceeds through the legal process, potentially involving discovery, motions, and a trial, either with the government as the primary prosecutor or with the relator’s counsel taking the lead if the government declined intervention.

- Settlement or Judgment in Healthcare Fraud: Many FCA healthcare fraud cases are resolved through settlements. However, as previously stated, if the case goes to trial, a judgment will be rendered.

Understanding the qui tam process allows healthcare workers to protect taxpayer dollars and ensure the integrity of our healthcare system. By following these crucial steps and securing qualified legal counsel, whistleblowers can play a vital role in holding fraudulent actors accountable.

Hiring Our Experienced Team of Healthcare Fraud Attorneys

Contact our law firm to speak with an expert about your case. Our reputation in this space is vast, and we’ve helped whistleblowers win massive multi-million-dollar qui tam awards for exposing healthcare fraudsters. Submit an intake today to request a free consultation. Our attorneys are standing by to help evaluate your claims and determine eligibility. There’s no fee unless we win.

Frequently Asked Questions

Frequently Asked Questions

False Claims Act Cases

Relevant FAQs

Latest News & Insights

January 22, 2025

Our pro bono team has helped lead the fight to pass amendments which would strengthen the False Claims Act (FCA).