What is IRS Form 211?

Whistleblowers seeking to claim an award for reporting tax evasion to the U.S. government must use Internal Revenue Service (IRS) Form 211, “Application for Award for Original Information.” If the IRS can recover funds based on a whistleblower's claim, the whistleblower will receive a percentage of these funds.

May 14, 2025

This information is provided for educational purposes only by Kohn, Kohn & Colapinto and does not constitute legal advice. No attorney-client relationship is created by accessing this content. Laws and regulations may change, and this material may not reflect the most current legal developments. If you believe you have a whistleblower claim, consult a qualified attorney to discuss your specific circumstances.

Whistleblowers seeking to claim an award for reporting tax evasion to the U.S. government must use Internal Revenue Service (IRS) Form 211, “Application for Award for Original Information.”

If the IRS can recover funds based on a whistleblower’s claim, the tax whistleblower will receive a percentage of these funds. Rewards for whistleblowers can be as high as 30% of the taxes, penalties, and other funds collected by the IRS based on the claim.

The IRS has two Whistleblower Reward Programs:

| Program 1: Internal Revenue Code Section 7623(b) | Program 2: Internal Revenue Code Section 7623(a) |

|---|---|

|

|

|

|

We are delighted to welcome the former acting chair and commissioner of the SEC, Allison Herren Lee, to our firm.

Now Of Counsel at Kohn, Kohn & Colapinto, Allison Herren Lee is ready to serve and protect whistleblowers, and help them seek rewards under the Dodd-Frank Act and SEC Whistleblower Program. If you’re an SEC whistleblower seeking to report a concern, contact our law firm today to speak confidentially with Allison Lee.

How do I know if I am eligible for a reward?

Whistleblowers do not need to be in the United States to report. Any whistleblower is able to utilize IRS Form 211 to claim a reward, with the exception of certain individuals. Those who are ineligible include current or former employees of the federal government who gained their information during the course of their official duties. Furthermore, individuals who were employed by the U.S. Department of the Treasury at the time when they received or provided information about tax evasion are also not eligible for this reward.

If a whistleblower is seeking a reward, they must have a claim that is specific, credible, and supported information. Reports may not be made out of suspicion or as a “guess.” The program looks for a “significant federal tax issue,” rather than a small tax mistake, so it is not intended to be used to settle personal disputes.

New Release

Rules for Whistleblowers

Read Rule 18: Tax Evasion and Underpayments: Report to the IRS to learn more about IRS whistleblowing.

Filing Form 211

Form 211 can be downloaded online from the IRS website. Section A of the form requires informants to attach information about the person or business that they are reporting and the whistleblower’s relationship or connection to them. The whistleblower should also provide information if they previous reported the violation. Section B of the form asks whistleblowers to provide information on the alleged violation. The whistleblower provide as much information as possible about the incident, including they type of violation, details of the alleged violation, how the whistleblower discovered the information, including documenst that support their information, and the amount of taxes owed by the taxpayer. In Section C of the form, whistleblowers will include information about themselves.

Once completed, the IRS whistleblower form must be signed, under penalty of perjury, and submitted by mail to the IRS at the following address:

Internal Revenue Service

Whistleblower Office – ICE

1973 N. Rulon White Blvd.

M/S 4110

Ogden, UT 84404

The IRS typically takes about 30 to 90 days to determine if a case is worth pursuing. In 2022, over 8,000 cases were closed because the IRS found that there was no actionable issue in the form. Other common reasons for the denial of a claim include: the issue is below the threshold for IRS Action and Short/Expired Statute of Limitations, among others.

Hiring an IRS whistleblower attorney

Improper completion of Form 211 can result in the closure of the case. Moreover, inclusion of inaccurate information is punishable under penalty of perjury. Therefore, whistleblowers seeking to effectively report would be wise to hire a whistleblower attorney to ensure they fill out IRS whistleblower form properly.

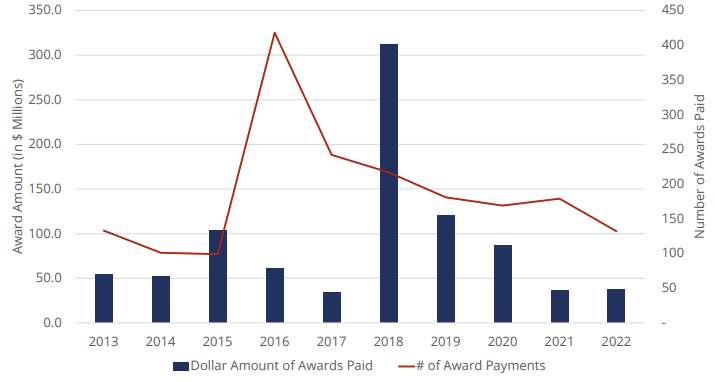

As evidenced in the graph above taken from the IRS Whistleblower Office’s 2022 Report, the percent of recovered funds awarded to whistleblowers can vary greatly based on a series of factors determined by the IRS. Given the high variability in rewards, the experienced and successful whistleblower lawyers at Kohn, Kohn, and Colapinto, LLP can help you win as much as possible.

The following positive factors may support increasing an award:

- The whistleblower acted promptly to inform the IRS or the taxpayer of the tax noncompliance.

- The information provided identified an issue or transaction of a type previously unknown to the IRS.

- The information provided identified taxpayer behavior that the IRS was unlikely to identify or that was particularly difficult to detect through the IRS’s exercise of reasonable diligence.

- The information provided thoroughly presented the factual details of tax noncompliance in a clear and organized manner, particularly if the manner of the presentation saved the IRS work and resources.

- The whistleblower (or the whistleblower’s legal representative, if any) provided exceptional cooperation and assistance during the pendency of the action(s).

- The information provided identified assets of the taxpayer that could be used to pay liabilities, particularly if the assets were not otherwise known to the IRS.

- The information provided identified connections between transactions, or parties to transactions, that enabled the IRS to understand tax implications that might not otherwise have been understood by the IRS.

- The information provided had an impact on the behavior of the taxpayer, for example by causing the taxpayer to promptly correct a previously-reported improper position.

The following negative factors may support decreasing an award:

- The whistleblower delayed informing the IRS after learning the relevant facts, particularly if the delay adversely affected the IRS’s ability to pursue an action or issue.

- The whistleblower contributed to the underpayment of tax or tax noncompliance identified.

- The whistleblower directly or indirectly profited from the underpayment of tax or tax noncompliance identified, but did not plan and initiate the actions that led to the underpayment of tax or actions described in IRC § 7623(a)(2).

- The whistleblower (or the whistleblower’s legal representative, if any) negatively affected the IRS’s ability to pursue the action(s), for example by disclosing the existence or scope of an enforcement activity.

- The whistleblower (or the whistleblower’s legal representative, if any) violated instructions provided by the IRS, particularly if the violation caused the IRS to expend additional resources.

- The whistleblower (or the whistleblower’s legal representative, if any) violated the terms of the confidentiality agreement described in 26 CFR 301.7623-3(c)(2)(iv).

- The whistleblower (or the whistleblower’s legal representative, if any) violated the terms of a contract entered into with the IRS pursuant to 26 CFR 301.6103(n)-2.

- The whistleblower provided false or misleading information or otherwise violated the requirements of IRC § 7623(b)(6)(C) or 26 CFR 301.7623-1(c)(3).

The process of gathering evidence and collecting tax funds is a long and arduous process, and whistleblower rewards are not paid until the IRS determines the final amount collected from a report.

For 7623(b) claims, i.e. Whistleblower Program 1, this takes on average 11.24 years, and for 7623(a) claims, i.e. Whistleblower Program 2, this takes on average 9.79 years, according to the IRS Whistleblower Office’s 2022 Report.

Our Firm’s Cases

$112.6 Million Award

Confidential Whistleblower’s disclosures resulted in 461 tax cheats paying over $562.9 million in fines and penalties. Whistleblower obtained awards of over $112.6 million. Client’s disclosures expected to trigger millions in additional awards and sanctions in 2024.

$11.9 Million Award

In July 2023, our client was awarded a significant sum of $11.9 million due to their involvement in the Tax Whistleblower Award Case No. 2015-11701. The IRS’s program for whistleblowers is a crucial mechanism that incentivizes individuals to spotlight tax fraud.

$11.9 Million Award

July 2023, our client obtained an award of $11.9 million in Tax Whistleblower Award in Case No. 2015-11793. The IRS whistleblower program offers substantial financial rewards to individuals who expose tax fraud.

Relevant FAQs

Latest News & Insights

February 24, 2026

February 24, 2026