Get in touch with our law firm today for expert legal assistance in reporting fraud or violations to FINRA and the Securities and Exchange Commission (SEC).

Understanding how to report misconduct, navigate rewards programs, and secure vital protections is crucial for whistleblowers reporting market manipulation, accounting fraud by broker-dealers, or failure to supervise. You need to fully understand the law to ensure you receive the maximum award amount and protection possible.

This is where Kohn, Kohn and Colapinto stands above the rest. We are the leading securities fraud attorneys in the world, whose matters have led to over $1.5 billion in recoveries and over $125 million in awards. One of our clients was the recipient of a landmark award, ranking among the top ten largest ever granted by the SEC.

Our FINRA Securities Fraud Lawyers

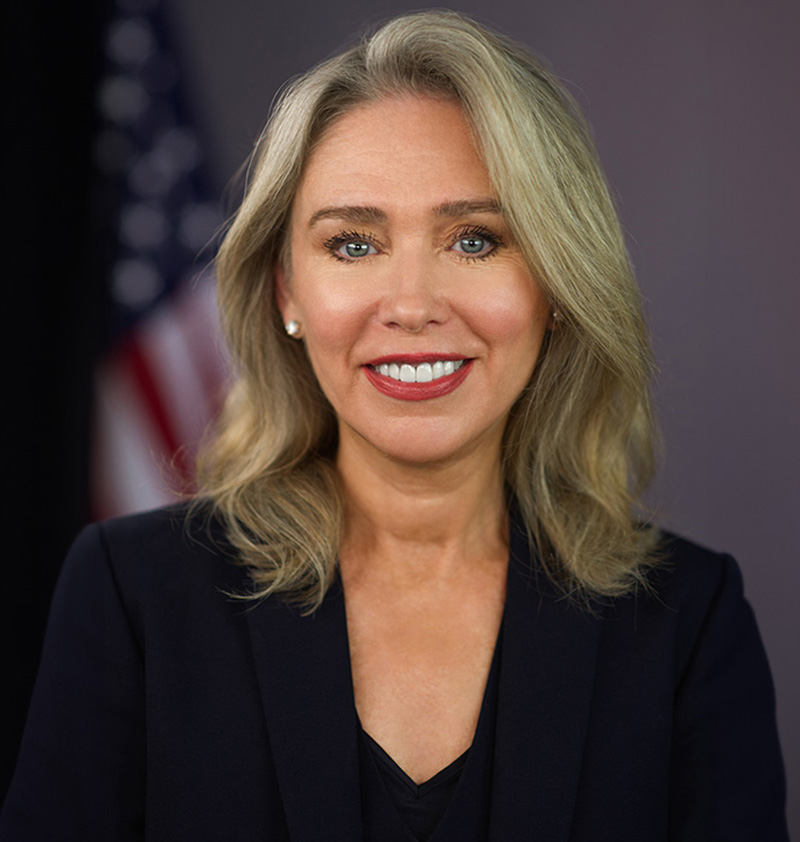

Our team is comprised of the world’s leading securities fraud attorneys, such as Allison Herren Lee, former acting Chair and Commissioner, and Andrew Feller, former Senior Counsel and Senior Policy Advisor to Commissioner Lee.

These leading securities fraud legal leaders are backed by world-renowned attorney and founding partner Stephen M. Kohn, recently honored as one of Forbes 2024 Top Lawyers, which is an award that can only be achieved through peer review.

Also on our team is David K. Colapinto, who has been representing whistleblowers for more than 35 years, winning major cases involving securities fraud. There is no better team to handle your FINRA and SEC tip than Kohn, Kohn & Colapinto.

Contact us for a free consultation today! We don’t get paid unless we win your case, so there’s no obligation unless we take you on as a client and obtain an award.

What is FINRA?

The Financial Industry Regulatory Authority (FINRA) is a self-regulatory organization overseen by the SEC. Its mission is to protect investors and ensure market integrity by regulating broker-dealer firms and their brokers in the U.S. FINRA establishes and enforces rules and can take disciplinary actions like fines or suspensions. While it doesn’t have a large direct financial reward program like the SEC, reporting to FINRA is a critical first step.

What Type of Misconduct Should Report?

FINRA investigates a wide array of abusive conduct and rule violations. Your information on issues like unauthorized trading, misrepresentation, or suitability violations is valuable. Here are some examples of what you can report:

- Sales Practices: this might include churning, which refers to a broker-dealer making excessive trades in a customer’s account to generate commissions without considering the customer’s investment objectives or suitability.

- Fraudulent Schemes: this might include Ponzi schemes or misrepresentation; this often includes a person or group collecting money from new investors to pay returns to earlier investors – however, these returns are not actually real.

- Operational Failures: this includes FINRA Rule 4530 failures, which require firms to report certain events to FINRA in a timely manner. This might include failure to report customer complaints, incorrect product codes, or failure to report violations.

- Market Manipulation: this might include trading schemes, such as momentum ignition, layering, front running, trading ahead, spoofing, wash sales, pre-arranged trading, and others that involve securities, such as stocks, ETFs, and options.

- Trading Violations: this might include a broad range of misconduct, like unauthorized trading or excessive trading, insider trading, and other forms of trading that aims to misuse customer funds for one’s own benefit.

Whistleblowers can report on these and other violations of securities laws or FINRA rules. For example, FINRA Rule 4530 outlines many events firms must self-report.

Filing a Tip with FINRA

FINRA encourages individuals with information about fraudulent or unethical activities to submit a regulatory tip. Here is the process:

- Prepare Information: gather the information that you have about fraud or misconduct. Some of the information may include: monthly account statements, canceled checks, correspondence (to and from the firm), advertising or marketing materials. FINRA asks that you do not provide personal confidential information such as financial account numbers, Social Security numbers, or driver’s license information. Such information will be requested by FINRA staff only when and if needed, and at the appropriate time.

- Submit Tip: use FINRA’s online form, mail, or by fax. You can submit a tip anonymously, but this may limit follow-up. Regardless, all regulatory tip information received will be treated confidentially.

- FINRA Review: once your tip has been submitted, FINRA will follow up with you to ask for more information. If the rules were violated, the FINRA Enforcement will decide whether to take formal disciplinary action: through settlement or litigation.

Before submitting, you should know that FINRA itself does not have a whistleblower award program. If you would like to submit a tip and have more questions, we suggest contacting our FINRA whistleblower attorneys for free and confidential consultation first – especially if you’re seeking an award and protection for your information.

Connecting Your FINRA Tip to SEC Whistleblower Rewards

A FINRA tip can be a vital step towards a significant monetary award from the SEC Whistleblower Program, which incentivizes individuals to report high-quality, original information leading to successful enforcement actions.

Key aspects of this program are:

- Whistleblower Awards: eligible whistleblowers can receive 10% to 30% of monetary sanctions collected if the action exceeds $1 million.

- Whistleblower Protection: eligible whistleblowers can receive protection from employer retaliation and can take further legal action if retaliation was experienced.

- Anonymous Filing: whistleblowers can submit tips to the SEC anonymously. However, they must be represented by an attorney to be eligible for an award.

It’s important to understand that to link your FINRA tip date to an SEC claim for award purposes, you must file a Form TCR with the SEC within 120 days of submitting your information to FINRA. Failure to file a TCR within this timeframe will make you ineligible for an award under the SEC whistleblower program.

Award Factors

Not every whistleblower receives a maximum award of 30%. There are many factors that the SEC considers when determining award percentages. Positive factors like significant information and cooperation can increase it, while negative factors like culpability or delay can decrease it.

This is why it’s so important to hire an experienced whistleblower attorney such as KKC on your side. We can help you navigate the complex process of reporting violations of securities laws and help you obtain the maximum award possible.

Essential Protections for Whistleblowers

There are several laws that exist in cases involving securities fraud

- Dodd-Frank Act: prohibits employer retaliation (firing, demotion, harassment) against those who report to the SEC. Provides a private right of action for remedies like reinstatement and double back pay. Under Dodd-Frank Act, SEC Rule 21F-17(a) prohibits anyone from impeding direct communication with the SEC about potential violations. This includes restrictive confidentiality or severance agreements. The SEC actively enforces this rule.

- Sarbanes-Oxley Act: offers separate protection for those who report fraud internally (e.g., to a supervisor) or to law enforcement, even without an SEC report. This provides an initial layer of safety.

These protections aim to create a safe environment for whistleblowers. Understanding them, and when they apply, is critical. Consulting with legal counsel can clarify your specific rights. Get in touch with one of our experienced FINRA attorneys today!

Get Legal Assistance

Your courage to report securities fraud is invaluable. By understanding the reporting channels, potential rewards, and robust protections, you can make an informed decision and contribute significantly to market integrity. If you have information about securities misconduct, get in touch with our securities fraud attorneys today for a free consultation.

Whistleblower Guides

Our Firms SEC Whistleblower Cases

We have successfully represented a number of SEC whistleblowers, preserving their anonymity and securing sizable whistleblower rewards. In one case, we helped our client receive one of the ten largest whistleblower awards ever granted by the SEC.

Our firm represented an anonymous whistleblower, who on May 17, 2021, received a whistleblower award of almost $13.5 million. The SEC has issued more than $31 million in whistleblower awards related to this case.

Protecting the confidentiality of Wall Street whistleblowers is among the most important breakthroughs in federal whistleblower law. Under the Dodd-Frank Act, whistleblowers can file anonymous cases, and everything about their case, including who they sued, remains secret.

Oil industry’s environmental crimes and cover-up in Colombia have been exposed. Whistleblower Andrés Olarte Peña, with the support of his attorneys Kohn, Kohn & Colapinto and the damning evidence compiled in the Iguana Papers, is calling for an investigation into Ecopetrol and its executives by the Colombian government and the U.S. Securities and Exchange Commission.

Latest from Our Blog

Former SEC officials lead the firm’s new group, representing whistleblowers who report financial fraud and legal violations to the SEC, CFTC, DOJ, FinCEN, and the IRS.

![Reporting Recordkeeping Failures To The Sec [2025 Guide]](https://kkc.com/wp-content/uploads/2025/01/Recordkeeping-Failures.jpg)