What is a Ponzi Scheme?

A Ponzi scheme is a fraudulent financial scam that pays returns to early investors using funds from new investors. This creates the illusion of a profitable venture, but since there’s no real business activity, the scheme crumbles when the influx of new investors slows down. This type of investment fraud is also called a high-yield investment program (HYIP), which indicates that one may receive high yields for investing in a security or commodity.

The SEC defines a Ponzi scheme as “an investment scam that involves the payment of purported returns to existing investors from funds contributed by new investors. Ponzi scheme organizers often solicit new investors by promising to invest funds in opportunities claimed to generate high returns with little or no risk. In many Ponzi schemes, rather than engaging in any legitimate investment activity, the fraudulent actors focus on attracting new money to make promised payments to earlier investors as well as to divert some of these “invested” funds for personal use.”

Under the SEC Whistleblower Program, if you know of a Ponzi scheme, you may be eligible for protection and an award of between 15 and 30 percent of the monies collect in a succesful enforcement action. To meet eligibility, your information must be specific, credible, and timely, among other requirements. Continue reading to learn more about your rights and legal options!

History of the Ponzi Scheme

Cerca 1920

Charles Ponzi

The name Ponzi scheme comes from the Italian-born swindler and con artist Carlo “Charles” Ponzi, who in 1920, came to the U.S. with a money-making scheme. In essence, Ponzi would guarantee clients 50% profit within 45 days, and 100% in 90 days through the arbitrage of postal reply coupons Investors were attracted to this scheme, and instead of investing the money on coupons, Ponzi simply redistributed it to previous investors, telling them they made a profit. The Ponzi scheme was named after Mr Ponzi, but the original scheme can be attributed to William “520 per cent” Miller, or Adle Spitzeder of Germany or Sarah Howe.

William “520 per cent” Miller

Operating in 1899, William Miller orchestrated a scheme known as the Franklin Syndicate. He captivated investors in New York with the astounding promise of a 10% weekly return, an annual rate that earned him the moniker “520 per cent” Miller.

Intriguingly, his operation predates Charles Ponzi’s more famous scheme by roughly two decades, suggesting a possible influence. Miller successfully defrauded approximately 13,000 individuals, accumulating over $1 million.

Ultimately, his fraudulent activities were exposed, partly due to a libel lawsuit initiated by a newspaper editor. Following the scheme’s collapse, victims pursued legal avenues to recover their lost investments.

Adle Spitzeder

Adle Spitzeder initiated her deceptive banking enterprise in Germany in 1869. She drew in depositors by offering remarkably high monthly interest rates, reportedly around 10%. Mirroring later Ponzi schemes, she utilized funds from new investors to provide returns to earlier participants.

Her venture experienced substantial growth, and at its peak, she was recognized as the wealthiest woman in Bavaria. By the time her scheme unraveled in 1872, she had amassed approximately 38 million Gulden from about 32,000 individuals.

Although explicit laws against Ponzi schemes were absent at the time, she was convicted of improper accounting and mishandling client funds, resulting in a three-year prison sentence.

The downfall of her “Spitzedersche Privatbank” inflicted significant financial losses on numerous people and is regarded as one of the largest fraud cases in 19th-century Bavaria.

Sarah Howe

Sarah Howe conducted her fraudulent activities in Boston during the late 1870s and 1880s. Her most notable scheme was the “Ladies’ Deposit Company,” which she falsely presented as a savings bank exclusively for unmarried women.

She deceptively claimed an affiliation with a Quaker charity and promised exceptionally high interest rates, initially 2% per week and later 8% per month. Howe primarily relied on referrals rather than advertising to attract investors, predominantly women of modest means. She amassed approximately $500,000 from about 1,200 women.

The scheme collapsed in 1880 after a newspaper began publishing exposés, triggering a run on the “bank.” Howe was subsequently convicted of fraud and sentenced to three years in prison. Following her release, she attempted similar fraudulent ventures, including another “Women’s Bank,” leading to her re-arrest.

Difference Between Ponzi Scheme vs Pyramid Scheme

A Ponzi scheme promises future returns on a particular investment and requires new investors to be brought into the fold for the scheme to succeed. Whereas a pyramid scheme promises easy profits to an “investor” who brings along another “investor” and relies heavily on new member / investor recruitment for the scheme to succeed. Some of the key differences between the two are:

- Focus: a Ponzi scheme promises high returns on said investments, with those “returns” being paid out of the funds of new investors. Whereas in a pyramid scheme, participants are actively involved in recruitment, and the scheme requires members to recruit new members to make money.

- Participant Activity: in a Ponzi scheme, all the investor needs to do is invest their money and wait for a return, which is actually just funds from new investors. As opposed to a pyramid scheme, where participants are actively recruting, because their income depends on recruiting more people.

- Products or Services: Ponzi schemes do not have a real product or service. In some instances, this scheme may talk about investing in a pre-IPO. Contrastingly, pyramid schemes may include a product or service of little to no value to further disguise the scheme.

- Sustainability: in most Ponzi schemes, recruitment isn’t essential and can go on for a very long time. In a pyramid scheme, however, it can be increasingly difficult to recruit new participants, which ultimately leads to it’s collapse.

- Legality: Ponzi schemes are 100% illegal and fraudulent, whereas a pyramid scheme can be legitimate if there is a decent product or service being sold, with an emphasis on sales rather than recruitment, with the latter being illegal.

If you’re ever offered an investment opportunity with high returns or a heavy emphasis on recruitment, it’s a major red flag. It’s best to avoid such schemes and invest through legitimate channels. Always do your research, and remember: if it sounds too good to be true, then it probably is.

“Red Flags” of a Ponzi Scheme

The Securities and Exchange Commission (SEC) has identified the following red flags to watch out for, which often point to a Ponzi scheme:

- Unsustainably High Returns with Little to No Risk: Legitimate investments involve some level of risk. If an opportunity promises high returns with minimal risk, it’s a major red flag. Be especially cautious of guarantees – the market fluctuates, and no one can consistently predict future returns.

- Unrealistic Consistent Returns: The market has ups and downs. An investment that consistently delivers high returns regardless of overall market conditions is a strong indicator of a Ponzi scheme. Real investments experience some volatility.

- Unregistered Investments: Legitimate investment opportunities are registered with financial authorities like the SEC. If an investment isn’t registered, it’s likely a scam. Don’t invest in anything that can’t provide proper registration documentation.

- Overly Complex or Secretive Investment Strategies: If the investment advisor can’t explain the strategy in a clear and understandable way, it’s a bad sign. Be wary of explanations that are complex or shrouded in secrecy. You should feel comfortable understanding how your money is being invested.

- Lack of Access to Investment Paperwork: A legitimate investment advisor will readily provide you with detailed documentation about the investment, including prospectuses, account statements, and other relevant materials. If you’re denied access to this paperwork, it’s a major red flag.

- Difficulties Withdrawing Money: If you encounter unexpected hurdles or delays when trying to withdraw your money, it’s a strong sign of a Ponzi scheme. Legitimate investments allow for reasonable access to your funds.

Investor Tips:

- Do your research: Before investing, thoroughly research the opportunity, the company, and the individuals involved. Look for red flags mentioned above. Use credible sources like the SEC website.

- Beware of pressure tactics: Legitimate investment advisors won’t pressure you into quick decisions. Be wary of high-pressure sales tactics that try to create a sense of urgency.

- Diversify your investments: Don’t put all your eggs in one basket. Spread your investments across different asset classes to manage risk.

- Seek professional advice: If you’re unsure about an investment opportunity, consult with a qualified financial advisor.

By being aware of these warning signs and taking appropriate precautions, you can protect yourself from falling victim to a Ponzi scheme. Remember, if something sounds too good to be true, it probably is.

Cryptocurrency Ponzi Schemes

The U.S. Securities and Exchange Commission (SEC) warned investors in July 2013 about the rise of Ponzi schemes in the cryptocurrency industry. The SEC was concerned not only about Ponzi-style scams involving buying and selling cryptocurrencies, but also about the potential use of cryptocurrencies for other crimes due to their lack of oversight.

Rug Pulls: Another Threat in Crypto

A common crypto scam is the rug pull, an exit scam where developers create a fake buzz around a cryptocurrency, inflate its price, and then suddenly abandon the project, draining all its value. This leaves investors with worthless tokens and an empty liquidity pool.

Beware of Hype and Secrecy

Crypto scams, such as a rug pull, often use social media influencers or create a sense of urgency to pressure quick investment decisions. Be wary of celebrity endorsements, as they might not fully understand the project. Similarly, avoid platforms that claim secret trading methods with guaranteed returns. This is often a way to hide the fact that there’s no real trading and that payouts come from new investors.

By understanding these red flags, you can be a more informed investor in the cryptocurrency space.

Ponzi Scheme Example

Imagine for a moment, two friends Hayes and Robert.

Hayes promises Robert 20% return on a particular investment of $1,000. Robert decides to invest, expecting the value of that $1,000 to increase to $1,200 by the end of the year. During that same year, Hayes also promises his friend Lynn a 20% return on the same investment of $1,000. She agrees and expects $1,200 by the end of the year as well.

Now, Hayes (the fraudster) has $2,000 on hand, and is able to make Robert whole by paying him $1,200 as he expects. However Hayes must continue to recruit new investors in order to pay back Lynn, as he is shy -$200 after his payment to Robert, or more if he is using this money for personal purchases.

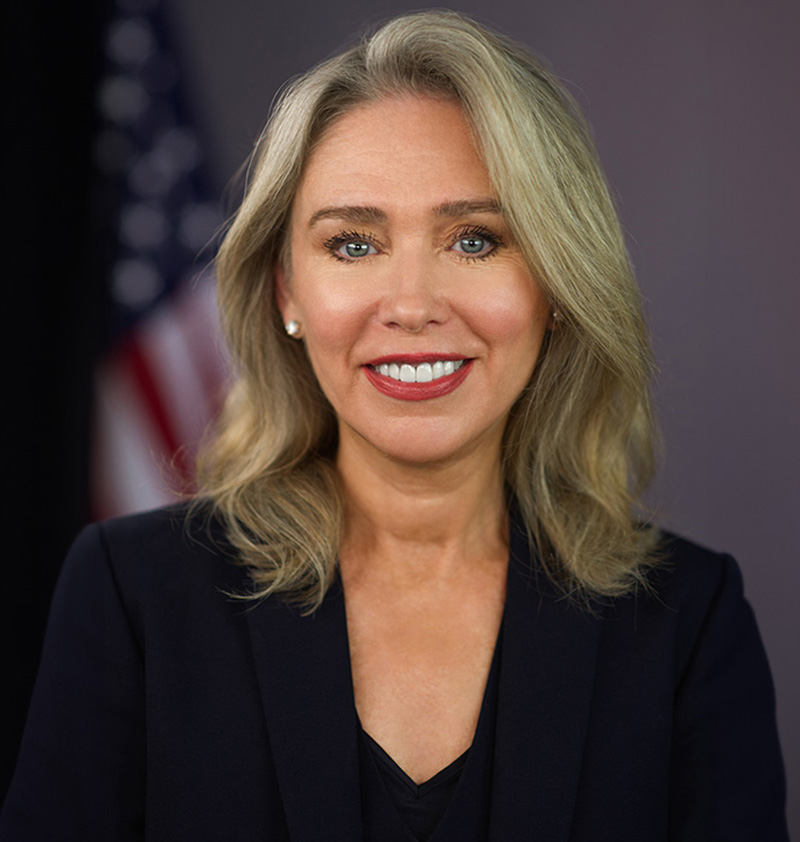

Ex-SEC Chair Allison Herren Lee Augments Kohn, Kohn & Colapinto’s Fight Against Ponzi Schemes

Allison Herren Lee, a highly respected former SEC acting chair and commissioner, now brings her considerable expertise to Kohn, Kohn & Colapinto as Of Counsel. Her thorough understanding of the Dodd-Frank Act and the SEC Whistleblower Program uniquely equips her to protect and advocate for whistleblowers seeking to expose Ponzi schemes and similar fraudulent activities.

Reporting a Ponzi Scheme Under the SEC Whistleblower Program

The SEC Whistleblower Program plays a major role in support whistleblowers who expose Ponzi schemes. The program offers rewards and protections to those who provide specific, credible, and timely information to the SEC. With the help of an attorney, whistleblowers are able to anonymously report their concerns without fear of retaliation. Below are some of the main features of the program:

Whistleblower Rewards

Under the Dodd-Frank Act, whistleblowers who provide the SEC with specific, credible, and timely information about a Ponzi scheme may be eligible to receive a whistleblower reward of between 10% and 30% of the monetary sanctions collected in actions brought by the SEC and related actions brought by certain other regulatory and law enforcement authorities.

Whistleblower Protection

Whistleblowers who fear retaliation are protected under the SEC Whistleblower Program.

Those who retaliate against a whistleblower can be sued in federal court, and the court can order the company to reinstate the whistleblower, award back pay (with interest), and compensave the whistleblower for any legal fees incurred. There are some instances when a whistleblower can be eligible for backpay.

Even if the whistleblower claim doesn’t lead to an enforcement action, whistleblowers are still protected. These protections aim to deter companies from retaliating against a whistleblower while encouraging an atmosphere of safe and open reporting within an organization.

Enforcement

SEC investigations take time and resources. Given the secret and complex nature of Ponzi schemes, information from insiders, or whistleblowers, allows the SEC to prioritize cases and take quicker action to stop ongoing schemes and protect potential victims.

Take for instance Bernie Madoff, who scammed investors out of $64 billion. This case predates the SEC Whistleblower Program, which was established in 2010. If it was established many years prior, it may have prevented this scheme from happening.

Bernie Madoff and the Most Famous Ponzi Scheme in History

Bernie Madoff was an American con artist responsible for the largest Ponzi scheme in history, defrauding investors of over $64.8 billion over the course of more than 17 years. Although nobody knows how long this scheme was going on for.

Madoff promised investors extremely high returns for investing in their firm’s split-strike conversion strategy. When receiving cash in for the investment, Madoff would use it to pay existing clients who wanted to cash out. And the scheme continued until 2008, until Madoff revealed the scheme to his sons, who immediately turned him in to authorities.

Like most con artists, Madoff had created a charismatic persona that attracted investors. He was often described as being generous, giving, and charitable. With this persona, he was able to defraud nonprofits, charities, and $2.4 billion from members of his synagogue.

The Bernie Madoff case exposed weaknesses in the financial regulatory system. The creation of the SEC Whistleblower Program in 2010 was a direct response to these shortcomings.

-

Increased Incentives for Whistleblowers: The program offers financial rewards and legal protections, making it more likely that individuals with knowledge of wrongdoing will come forward.

-

Enhanced Enforcement Capabilities: The program provides the SEC with valuable information that can be used to prioritize cases and dedicate resources towards investigating potential Ponzi schemes and other securities violations.

By offering a robust framework for whistleblowers and strengthening the SEC’s enforcement capabilities, the program aims to prevent frauds like the Madoff scheme from continuing undetected for extended periods.

Seeking Legal Assistance

If you suspect you’ve encountered a Ponzi scheme or have inside knowledge of its operation, quietly seek legal assistance. Ponzi schemes harm innocent investors, and those with knowledge have a chance to make a difference.

Contact our firm today for a free and confidential consultation. Remember, you are protected. Whistleblower programs safeguard individuals who report wrongdoing. By coming forward, you can help stop the scheme from harming others, potentially recover your own losses and qualify for a whistleblower reward.

Our Firm’s Expert SEC and CFTC Attorneys Tackling Cases Involving Ponzi Schemes

Frequently Asked Questions

Our Firm’s Cases

Environment & Human Rights Violations Exposed

Oil industry’s environmental crimes and cover-up in Colombia have been exposed. Whistleblower Andrés Olarte Peña, with the support of his attorneys Kohn, Kohn & Colapinto and the damning evidence compiled in the Iguana Papers, is calling for an investigation into Ecopetrol and its executives by the Colombian government and the U.S. Securities and Exchange Commission.

$30 Million Award

Protecting the confidentiality of Wall Street whistleblowers is among the most important breakthroughs in federal whistleblower law. Under the Dodd-Frank Act, whistleblowers can file anonymous cases, and everything about their case, including who they sued, remains secret.

$13.5 Million Award

Our firm represented an anonymous whistleblower, who on May 17, 2021, received a whistleblower award of almost $13.5 million. The SEC has issued more than $31 million in whistleblower awards related to this case.

Relevant FAQs

Latest News & Insights

Former SEC officials lead the firm’s new group, representing whistleblowers who report financial fraud and legal violations to the SEC, CFTC, DOJ, FinCEN, and the IRS.

![Reporting Recordkeeping Failures To The Sec [2025 Guide]](https://kkc.com/wp-content/uploads/2025/01/Recordkeeping-Failures.jpg)