The Law Firm Whistleblowers Go to for Serious Commodities Violations

Kohn, Kohn and Colapinto is recognized as one of the world’s leading whistleblower law firms representing CFTC whistleblowers who report violations of the Commodities Exchange Act, such as commodities fraud, market manipulation, and other derivatives-related misconduct. Our team can help you determine if you’re eligible for awards under the CFTC whistleblower program, and protection against retaliation under the Dodd-Frank Act.

Confidentially Report Commodities Fraud and Other Violations with Renowned Federal Whistleblower Attorneys

Since 1988, our firm has been dedicated to helping commodities fraud whistleblowers report concerns to the CFTC and seek protection and awards. Our Commodities Whistleblower Group is led by former federal attorneys.

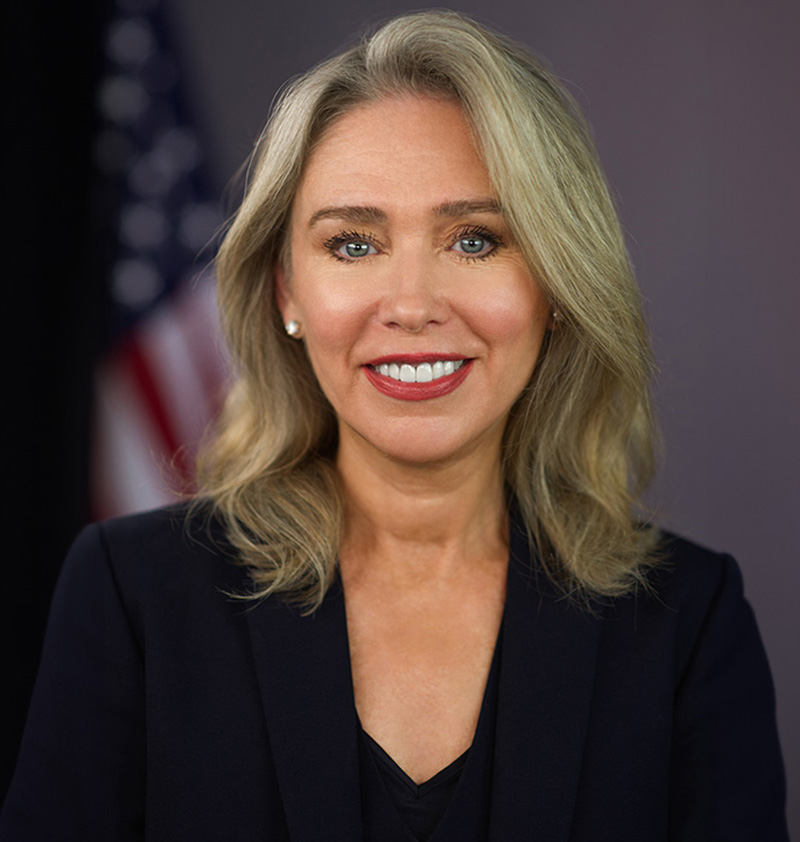

Our commodities fraud attorneys include Allison Herren Lee, former SEC acting chair and commissioner at the U.S. Securities and Exchange Commission (SEC), who is of counsel at the firm, and Andrew Feller who spent 15 years at the SEC investigating and litigating securities fraud matters as Senior Counsel in the Division of Enforcement and later worked as Associate General Counsel at a CFTC-registered entity.

This group is backed by securities and commodities fraud experts and founding partners Michael D. Kohn, Stephen M. Kohn, and David K. Colapinto, who have fought and won countless cases involving market manipulation schemes, spoofing, cryptocurrency fraud, commodities futures, commodity options, swap trading markets, derivatives, international foreign corrupt practices and other CFTC violations.

Record Breaking Whistleblower Cases

Our firm is best known for helping clients obtain massive awards. This includes Bradley Birkenfeld, a former UBS banker in Switzerland, who blew the whistle on a massive tax evasion scheme under the IRS whistleblower program and awarded $104 million for his information.

Also clients like Howard Wilkinson, a former Danske Bank manager who exposed a $230 billion money laundering scheme that moved dollars to New York with help from Bank of America, J.P. Morgan, and Deutsche Bank.

There is no case too large for our firm to handle. If you seek justice, protection, and awards, get in touch with our firm today for a free and confidential consultation. Our CFTC whistleblower lawyers work on a contingency basis, which means there is no fee unless we win your case.

“The only lawyer on my side was Steve Kohn. He was as smart as they come and feisty as a pit bull. Steve was convinced the government owed me a fat reward, and he was going to get it, or die trying.”

The CFTC Whistleblower Program

The CFTC is responsible for regulating the commodities markets and relies heavily on tips from whistleblowers to help expose violations of the Commodities Exchange Act and enforce the law.

This is because whistleblowers, who are often employees or those with insider knowledge, have access to information regarding illegal activity that would otherwise go unnoticed by customers, investors, or other commodities market participants.

Types of fraud include:

- Commodities market fraud and manipulation: This includes market manipulation, spoofing, insider trading, forex fraud, carbon markets fraud, and precious metals fraud.

- Investment scams: This includes Ponzi schemes, affinity frauds, and digital asset and cryptocurrency frauds, such as those that occur on the blockchain.

- Deceptive scams: This has been a new area of interest for the CFTC, and includes grooming and/or romance scams, or imposter fraud.

- Regulatory violations: This includes violations of the Bank Secrecy Act (BSA), registration violations, and unauthorized trading or excessive trading, such as churning or position-limit violations.

- False reporting: this includes providing inaccurate or incomplete information in filings to the CFTC or National Futures Association.

This is just a partial list. The CFTC enforces many rules, and there are a wide variety of other potential violations.

Since its 2010 inception, the CFTC whistleblower program has awarded over $390 million to whistleblowers. Enforcement actions associated with those awards have resulted in monetary relief totaling more than $3.2 billion.

CFTC Whistleblower Protections

The CFTC pays significant awards to whistleblowers who come forward with “original information,” if that information leads to an enforcement action with monetary sanctions exceeding $1,000,000, among other eligibility factors. Awards range between 10 to 30% of the collected proceeds, also depending on many factors.

In addition, the CFTC provides whistleblowers with protection against retaliation and other actions meant to interfere with whistleblowers’ ability to report their information to the government. Even if an employer finds out who the whistleblower is, they are prohibited from retaliating against the whistleblower under the Dodd-Frank Act. Section 748 of the Dodd-Frank Act amends the CEA by adding Section 23, entitled “Commodity Whistleblower Incentives and Protection.”

Whistleblowers can also submit tips anonymously, which is a strong incentive to come forward.

Whether you’re a U.S. citizen or foreign national, if you have information that would help the CFTC carry out its mission of protecting investors and the integrity of the commodities and futures markets, we urge you to reach out to a CFTC whistleblower lawyer from our firm to explore your legal options.

Our CFTC law firm is based out of Washington, DC, but given that commodities fraud violations can happen anywhere, we can handle cases in all 50 states, and internationally.

What is Considered “Original Information” in a CFTC Case?

Original information is information not already known to the CFTC that is derived from:

- Your independent knowledge: Information in your possession that is not generally known or available to the public.

- Your independent analysis: Your examination and evaluation of information that may be publicly available, but which reveals information that is not generally known.

Fo instance, if the CFTC received the same tip or information previously from someone else, your information will not be considered original information unless you can show that you were the “original source” of the information. (Read the regulations).

Another key requirement for the CFTC whistleblower program is that you voluntarily disclose the information before any request, inquiry, or demand for it is issued by the CFTC, Congress, or another regulatory agency to you, your lawyer, or your employer.

Process of Submitting a Tip to the CFTC

Submitting a Tip, Complaint, or Referral (TCR) to the CFTC can be done online or by mail or fax, but the CFTC strongly encourages individuals to submit their TCRs through the CFTC’s online portal. The actual process can be complex and may require documentation to back up your claims.

Failure to fill out complete the TCR correctly or provide sufficient evidence may result in your claim being denied – so take time to prepare before starting the process. We encourage you to contact a whistleblower attorney at our firm to help you maximize your chances at not only successful case acceptance, but also any potential award.

Here is what we can help you with:

- Free case review: Once you submit an intake on our site, our attorneys are happy to conduct a free consultation to determine whether we can offer representation in connection with your case.

- Prepare documentation: Our attorneys can help you prepare documentation and provide guidance on how to obtain evidence.

- Prepare TCR: If you hire our firm, we’ll help you prepare the TCR form for submission. Our attorneys have extensive experience with this potentially complex process.

- Submit TCR: We’ll ensure your TCR is strong and credible and go over it with you to ensure you are fully involved in the process and understand your rights.

- Protect your identity: We’ll ensure you are able to submit anonymously to the CFTC if that is how you choose to proceed, and we will maintain strict confidentiality throughout the process.

- Representation: Once your TCR has been submitted, we will communicate with the CFTC, responding to any further questions and or requests for assistance.

If your information leads to the CFTC opening a new investigation, re-opening a closed investigation, or pursuing a new line of inquiry in an ongoing investigation, you may be eligible for an award if you meet certain criteria. Your assistance may also increase the size of any eventual award.

CFTC Award Application and Related Actions

Submitting a tip alone will not be sufficient to obtain an award. To be considered for an award, a whistleblower must also submit an award application when the Whistleblower Office releases a Notice of Covered Action, or when a judgment is issued in a Related Action.

Applications for awards must be submitted within 90 days of (1) a Notice of Covered Action being posted, or (2) the date of an order in a Related Action. Whistleblowers may also be eligible for awards based on Related Actions brought by certain other entities if there is also a successful CFTC action.

Read our FAQ CFTC Whistleblower Program: Guide to Reporting Commodities Fraud for a more comprehensive overview of the program and process.

Hiring Our Experienced Team of Veteran Attorneys

If you have questions or are seeking a case review, please contact our firm for legal assistance. Our firm has extensive experience and a strong reputation in whistleblower law, with a dedicated commodities practice designed specifically for commodities fraud whistleblowers like you.

Submit an intake today or give us a call at (202) 342-6980 for free consultation. Our attorneys are standing by to help evaluate your claims and determine eligibility. There’s no fee unless we win.

FAQs

Frequently Asked Questions

Recent Securites and Commodities Cases

Protecting the confidentiality of Wall Street whistleblowers is among the most important breakthroughs in federal whistleblower law. Under the Dodd-Frank Act, whistleblowers can file anonymous cases, and everything about their case, including who they sued, remains secret.

Latest from Our Blog

Our firm has worked directly with the Congressional offices responsible for oversight and funding of the CFTC’s Whistleblower Office in order to ensure that the program will continue to be an immense success.