List of SEC Violations

In the vast realm of financial markets, understanding SEC regulations is crucial for maintaining transparency and trust. This FAQ provides an insightful overview of potential SEC violations, serving as a compass for professionals, investors, and whistleblowers navigating the intricate landscape of securities compliance.

May 14, 2025

This information is provided for educational purposes only by Kohn, Kohn & Colapinto and does not constitute legal advice. No attorney-client relationship is created by accessing this content. Laws and regulations may change, and this material may not reflect the most current legal developments. If you believe you have a whistleblower claim, consult a qualified attorney to discuss your specific circumstances.

In today’s financial markets, the threads of trust, transparency, and compliance come together to create a system that’s both robust and fair. Key to maintaining this delicate balance is the adherence to rules and regulations set forth by the SEC.

However, the vastness and complexity of these regulations can often be bewildering. Violations can occur intentionally or inadvertently, but in either scenario, they threaten the very integrity of the market, jeopardizing investors and undermining public confidence.

To genuinely grasp the essence of market integrity and the pivotal role that compliance plays, one must first understand the array of potential pitfalls—namely, the various SEC violations. These violations range from disclosure lapses to more overt fraudulent activities, each carrying its own set of consequences.

Below is a short, yet comprehensive list of violations for professionals, investors, and whistleblowers alike. By familiarizing oneself with these violations, one is better equipped to navigate the securities world with discernment and vigilance, and or to become a whistleblower. Those who do come forward to become a whistleblower, may be eligible for protections and rewards under the SEC Whistleblower Program.

Continue reading to view the list and to learn more about this program.

Allison Herren Lee, Former SEC Acting Chair and Commissioner, Joins Our Firm to Protect and Represent SEC Whistleblowers

As Of Counsel at Kohn, Kohn & Colapinto, Allison Herren Lee brings her expertise to support whistleblowers under the Dodd-Frank Act and SEC Whistleblower Program. If you have information about an SEC violation and seeking guidance about such financial abuse, arrange a confidential consultation with Allison Lee today.

SEC Violations

Disclosure Violations

Securities issuers are required to provide investors with detailed and accurate information. Violations occur when there are:

- Misrepresentations or Omissions – providing false or incomplete information to investors.

- Inaccurate Financial Statements – presenting financials that don’t reflect the true financial position of a company.

- Failure to File Timely Reports – companies must file regular reports (e.g., 10-Ks and 10-Qs). Delays or failures can be violations.

Insider Trading

This involves trading based on non-public material information:

- Illegal Trading – buying or selling stocks with knowledge of confidential information.

- Tipping – Providing insider information to someone else, enabling them to profit or avoid losses.

Market Manipulation

Manipulating the stock market to benefit unfairly:

- Pump and Dump – artificially inflating the price of a stock and then selling it.

- Churning – excessive buying/selling to generate commission.

- Misinformation – spreading false rumors to influence stock prices.

- Wash Sales – buying and selling securities to generate activity and manipulate price.

Fraud

Deceptive practices to benefit at the expense of others:

- Misrepresentation & Mismarking – providing false information to investors.

- Ponzi Schemes – using funds from new investors to pay returns to earlier investors.

- Pyramid Schemes – recruiting investors with promises of high returns, based on recruiting others.

- High-yield Investment Fraud – promising high returns without any basis.

Broker-Dealer Misconduct

Brokers must act in the best interest of their clients:

- Unauthorized Trading – making trades without the client’s consent.

- Churning – excessive trading to earn more commission.

- Failure to Supervise – not overseeing broker actions effectively.

- Selling Away – selling securities that aren’t offered by the broker’s firm.

Investment Adviser Misconduct

Investment advisers must act in clients’ best interests:

- Breach of Fiduciary Duty – not acting in the client’s best interest.

- Conflicts of Interest – benefiting at the expense of the client.

- Excessive Fees – charging clients unfairly high fees.

Municipal Securities Violations

Rules for securities from local governments:

- Misrepresentations – providing false information in official statements.

- Pay-to-Play – giving something of value for the business.

- Improper Gifts – giving unauthorized gifts to municipal employees.

Foreign Corrupt Practices Act (FCPA) Violations

Rules for U.S. entities operating abroad:

- Bribery – offering anything of value to foreign officials for business favors.

- Inaccurate Books and Records – not maintaining accurate financial records.

- Lack of Internal Controls – not having systems to detect and prevent violations.

Registration Violations

All securities sold must be registered unless exempt:

- Failure to Register Offerings – not registering securities before offering.

- Unregistered Brokers or Dealers – brokers/dealers operating without SEC registration.

Violations of Whistleblower Protections

Protections for those who report violations:

- Retaliation – punishing employees for reporting violations.

Short Selling Violations

Rules for selling stocks that you don’t own:

- “Naked” Short Selling – selling short without borrowing securities.

- Failure to Deliver – not providing securities by the settlement date.

Regulation SHO Violations

Rules related to short sales and failures to deliver.

Regulation M Violations

Rules to prevent market manipulation during stock distributions.

Violations of Regulation D

Rules for small, private company offerings.

Violations of Regulation T

Freeriding or other tactics to manipulate market prices or mislead other investors.

Sarbanes-Oxley Act Violations

Corporate responsibility for financial reports:

- Inaccurate Reports – providing false financial reports.

- Certification Failure – executives not certifying financial statements.

This list provides an overview of the most common types of violations. But as securities law is complex and continually evolving, it’s essential to consult official SEC resources or with one of our SEC whistleblower attorneys for the most accurate and updated information.

SEC Whistleblower Program

Upholding integrity and transparency of financial markets is paramount. Ensuring the fair operation of financial markets depends on the vigilance of not just regulators, but also participants in the industry and the public at large. Thus, whistleblowers who come forward to report potential violations of securities laws to prevent misconduct cannot be understated.

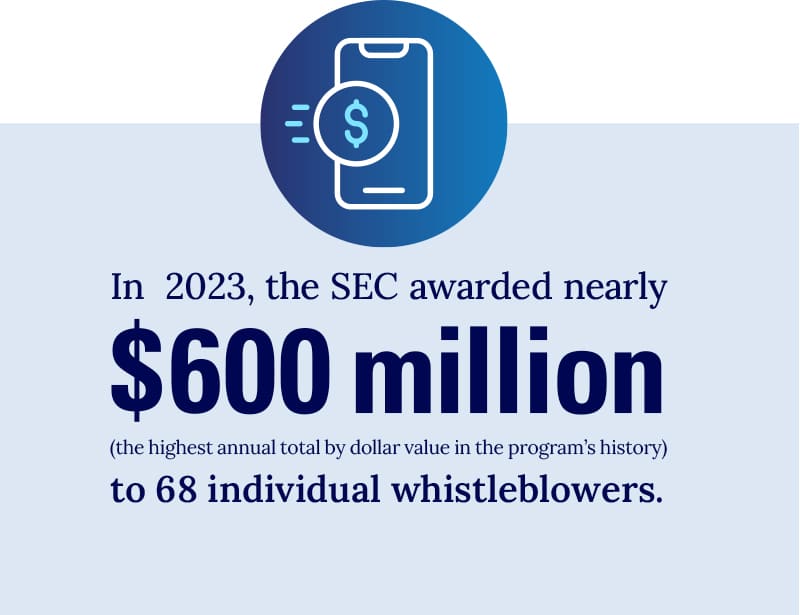

Recognizing the significance of whistleblowers, the U.S. Securities and Exchange Commission (SEC) established the SEC Whistleblower Program. This program is a critical component of the Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in 2010, which aims to improve accountability and transparency in the financial system.

The Whistleblower Program encourages individuals to report possible violations of securities laws by offering certain protections and, in some cases, monetary rewards. Key features of the program include:

- Confidentiality – whistleblowers can report violations anonymously, although they must be represented by an attorney to do so.

- Protection Against Retaliation – it is illegal for employers to retaliate against employees for reporting possible securities law violations, whether reported internally or to the SEC.

- Monetary Rewards – if the information provided by the whistleblower leads to an SEC enforcement action resulting in sanctions over $1 million, the whistleblower may be eligible for a reward ranging from 10% to 30% of the money collected.

For those considering blowing the whistle on securities law violations, understanding the potential violations is the first step. If you have information about a securities violation, it is imperative that you step forward and play a pivotal role in maintaining the integrity of financial markets.

We understand that coming forward with such information can be daunting and might carry concerns about confidentiality and potential repercussions. At Kohn, Kohn & Colapinto, we’re committed to guiding you through the process, ensuring your rights are protected, and making certain your information reaches the right channels within the SEC. Submit an intake today to request a free consultation.

Related FAQs

Our Firm’s SEC Cases

From Our Blog

A Message from SEC Chair Gensler

Our Firm’s Cases

Environment & Human Rights Violations Exposed

Oil industry’s environmental crimes and cover-up in Colombia have been exposed. Whistleblower Andrés Olarte Peña, with the support of his attorneys Kohn, Kohn & Colapinto and the damning evidence compiled in the Iguana Papers, is calling for an investigation into Ecopetrol and its executives by the Colombian government and the U.S. Securities and Exchange Commission.

$30 Million Award

Protecting the confidentiality of Wall Street whistleblowers is among the most important breakthroughs in federal whistleblower law. Under the Dodd-Frank Act, whistleblowers can file anonymous cases, and everything about their case, including who they sued, remains secret.

$13.5 Million Award

Our firm represented an anonymous whistleblower, who on May 17, 2021, received a whistleblower award of almost $13.5 million. The SEC has issued more than $31 million in whistleblower awards related to this case.

![Reporting Recordkeeping Failures To The Sec [2025 Guide]](https://kkc.com/wp-content/uploads/2025/01/Recordkeeping-Failures.jpg)