How Do I Report a Pump and Dump Scheme?

A pump and dump scheme is a fraudulent tactic where the orchestrators artificially inflate the price of a stock or other asset by spreading false or misleading information, only to sell off their own shares at the high price, causing the value to plummet and leaving other investors with significant losses.

May 14, 2025

This information is provided for educational purposes only by Kohn, Kohn & Colapinto and does not constitute legal advice. No attorney-client relationship is created by accessing this content. Laws and regulations may change, and this material may not reflect the most current legal developments. If you believe you have a whistleblower claim, consult a qualified attorney to discuss your specific circumstances.

A pump and dump scheme is a fraudulent tactic where the orchestrators artificially inflate the price of a stock or other asset by spreading false or misleading information, only to sell off their own shares at the high price, causing the value to plummet and leaving other investors with significant losses.

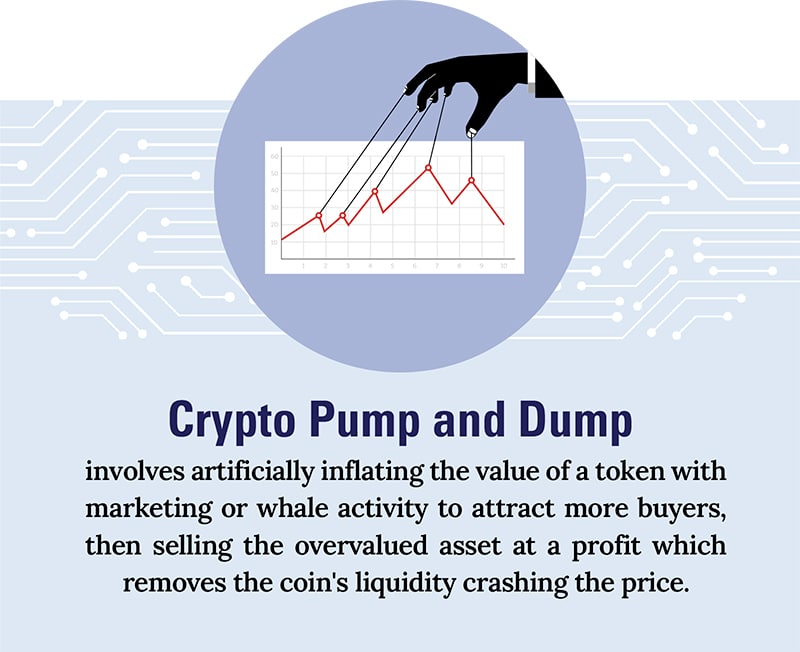

A pump and dump scheme is a fraudulent investment strategy often used in stock or cryptocurrency markets. In these schemes, companies or coin creators begin by spreading false or misleading information to create a buying frenzy and momentum. This deliberate misinformation is used to “pump” up the price of a stock or digital asset.

Following this artificial inflation, the fraudsters then “dump” shares of the stock by selling their own shares at the inflated price. Once the fraudsters dump their shares and stop promoting the stock or coin, the price typically falls sharply. As a result, investors who were lured into buying at the inflated prices lose money, while those participating in the scheme profit heavily.

Pumping and dumping is a manipulative practice that can lead to significant financial losses for unsuspecting investors.

Continue reading to learn how you can report pump and dump schemes under various U.S. laws and become eligible for a reward.

We are delighted to welcome the former acting chair and commissioner of the SEC, Allison Herren Lee, to our firm.

Now Of Counsel at Kohn, Kohn & Colapinto, Allison Herren Lee is ready to serve and protect whistleblowers, and help them seek rewards under the Dodd-Frank Act and SEC Whistleblower Program. If you’re an SEC whistleblower seeking to report a concern, contact our law firm today to speak confidentially with Allison Lee.

History of Pump and Dump Schemes

These schemes are far from a recent phenomenon; they were once the hallmark of “boiler room” frauds. These fraudulent operations aggressively marketed penny stocks by making false promises that the companies were on the brink of major breakthroughs, launching revolutionary products, or on the cusp of merging with well-established, blue-chip competitors.

As the demand in these thinly traded companies grew, the share prices would naturally rise. Once the prices reached a predetermined point, boiler room salespeople would then unload their remaining shares on the open market. Consequently, the prices would plummet, leaving investors stuck with nearly worthless stock.

Reporting Pump and Dump Schemes

Crypto tokens and exchanges are subject to various classifications and regulations by different financial authorities in the United States.

The Securities and Exchange Commission (SEC) treats them as a security, while the Commodity Futures Trading Commission (CFTC) regards them as a commodity or currency exchange.

Additionally, the Financial Crimes Enforcement Network (FinCEN), a specific bureau of the Treasury Department focused on combating money laundering, terrorist financing, and other financial crimes, categorizes them as a money services business.

This varied treatment often pertains to crypto companies, reflecting the complex and multifaceted nature of the regulatory environment surrounding cryptocurrencies.

Whistleblower Rewards for Reporting Pump and Dump Schemes

SEC Whistleblower Reward Program

Established under the Dodd-Frank Act, the SEC Whistleblower Reward Program is administered by the SEC Office of the Whistleblower. The program is designed to protect investors, maintain the integrity of U.S. capital markets, and promptly hold accountable those who violate securities laws. Authorized by Congress, the Securities and Exchange Commission can provide monetary rewards.

Eligibility for rewards requires that individuals come forward with original, credible information leading to an SEC enforcement action. To qualify for an award, the imposed sanctions must exceed $1 million, with the award amount ranging from 10 to 30 percent of the collected money.

Click here to learn more about the SEC Whistleblower Reward Program

FinCEN Whistleblower Rewards

The FinCEN Whistleblower Program enables individuals to receive rewards for supplying original, timely, and credible information concerning violations of the Bank Secrecy Act (BSA) or other FinCEN regulations.

To be eligible for an award, the sanctions must be over $1,000,000, with the potential reward amounting to up to 30 percent of the money collected.

Click here to learn more about the FinCEN whistleblower program.

CFTC Whistleblower Program

Under the CFTC Whistleblower Program, individuals who voluntarily submit information leading to a successful enforcement action with monetary sanctions over $1 million are entitled to an award. The award varies between 10-30% of the funds collected by the government in the action.

These programs are indicative of the multifaceted regulatory environment surrounding cryptocurrencies and highlight the concerted efforts by various government bodies to enforce compliance and protect investors.

Click here to learn more about the CFTC whistleblower program.

Examples of Pump and Dump Schemes

Regulatory agencies have taken an active role in investigating pump and dump schemes. FinCEN Fined Oppenheimer & Co. $20 million for failing to implement Anti-Money Laundering procedures and failing to have policies to report suspicious activities. FinCEN discovered 16 different suspicious pump and dump schemes that the company should have reported.

The SEC charged Arbitrade Ltd and others for participation in a crypto pump and dump scheme, resulting in proceeds totaling about $36.8 million. The litigation is active and not finished.

The CTFC charged John McAfee and Jimmy Gale Watson in its first ever digital currency manipulation enforcement for participation in a crypto pump and dump scheme which resulted in proceeds over $2 million. Watson was fined nearly $300,000 for his participation.

These case studies demonstrate that all three agencies with jurisdiction over crypto crimes are working to stop these schemes. Those who have information about potential pump and dump schemes employed by crypto companies can receive huge monetary rewards by blowing the whistle.

Seek Legal Assistance

Although it’s not mandatory to have a lawyer when filing a whistleblower case with the SEC, engaging a whistleblower attorney can be beneficial. Their expertise in this intricate legal field can enhance your case, and they can enable you to submit your complaint anonymously.